What is traditional Medicare?

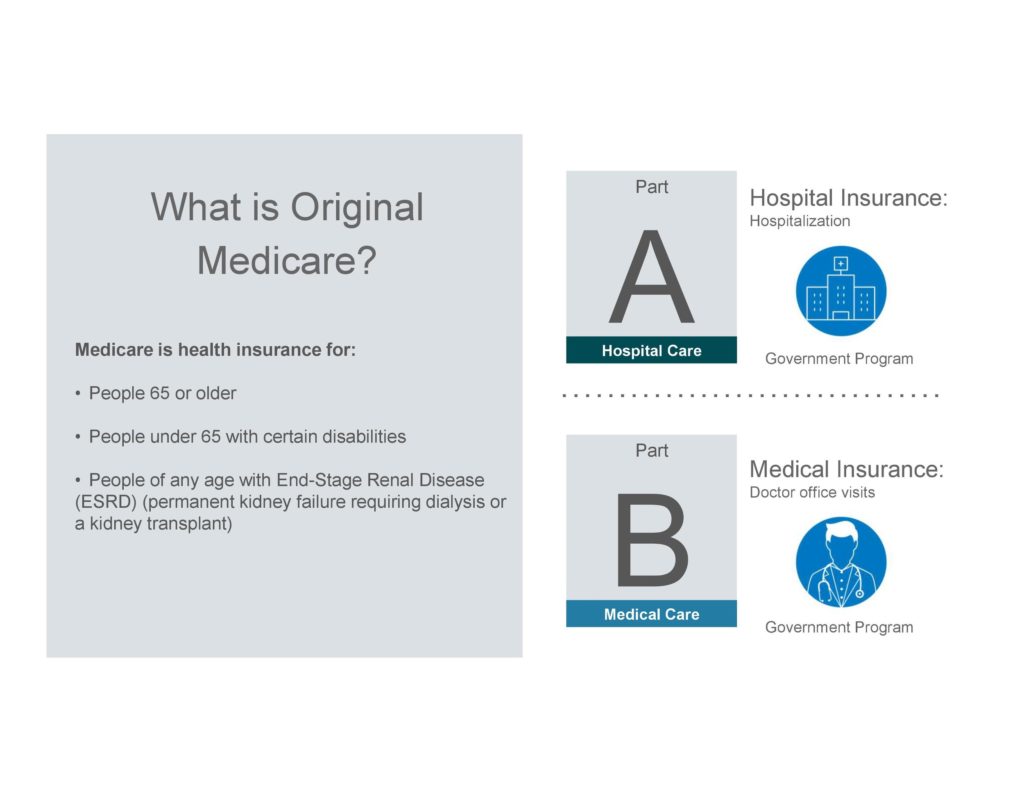

Traditional Medicare, also known as Original Medicare, is the federal health insurance program administered directly by the government for Americans aged 65 and older (also available for those who have been on disability for 2 years or more). It consists of two main parts that provide coverage for different healthcare services:

- Medicare Part A – This covers inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare. Part A helps pay for services associated with hospital stays, such as a semi-private room, meals, general nursing care, and drugs as part of inpatient treatment.

- Medicare Part B – This covers doctor’s services, outpatient care, durable medical equipment, and preventive services. Part B helps pay for services like doctor visits, outpatient procedures, lab tests, mental health services, and ambulance transportation.

Table of Contents[Hide][Show]

Together, Original Medicare Part A and Part B form the foundation of Medicare coverage, providing essential medical and hospital insurance for seniors and certain younger individuals with disabilities. It’s important to understand the scope of services covered under each part when evaluating Original Medicare and making decisions about supplemental coverage.

Find health plans under traditional Medicare in The Central Valley

For those residing in California, particularly in Fresno County and Madera County, finding your way through the myriad of health plans can be a challenging task. Yet, it’s important to make sure that you’re well-protected under either Original Medicare or Medicare Advantage plans.

Here are three key points to keep in mind:

Traditional Medicare Coverage: Original Medicare includes Part A, covering hospital stays and inpatient care, and Part B, covering doctor visits and outpatient services. You will have out-of-pocket costs so you will want to consider getting a Medicare Supplement plan or going with Medicare Advantage to keep costs down. If you doi choose to keep Original Medicare you will also need to enroll into a PArt D drug plan to avoid any penalties and have any pharmacy coverage. It’s essential to grasp these basics to make sure your healthcare needs are met in counties like Fresno and Madera.

Medicare Advantage Plans: In addition to Original Medicare, Medicare Advantage offers an alternative, combining Part A and Part B coverage and often including additional benefits and Part D drug coverage. These plans are provided by private insurance companies and can offer more extensive coverage, which might be a favorable option for some residents in the Central Valley.

Local Healthcare Networks: The choice between Original Medicare and Medicare Advantage can also depend on the preferred healthcare providers and hospitals in your area. It’s important to take into account the network of doctors and hospitals available to ensure that your healthcare plan aligns with your needs and preferences. If all of your doctors are local, then you may find Medicare Advantage to be an attractive option. In any case, it will be important to confirm all of your doctors will be in network for the plan you want.

Original Medicare Coverage

What sets Original Medicare apart from Medicare Advantage plans is the flexibility to see any doctor or provider that accepts Medicare, without the need for network restrictions or changing costs. However, it’s important to note the original Medicare deductible and other out-of-pocket costs can impact your overall healthcare expenses.

| Coverage Type | Out-of-Pocket |

| Medicare Part A | $1632 per benefit period (60 days). You will be charged a daily rate until you’ve passed 150 days of being hospitalized. After 150 days all costs will be passed to you. Skilled nursing stays will be $0 for the first 20 days. Days 21-100 will be billed at $204 a day. After 100 days you will pay 100% of the costs. |

| Medicare Part B | You will pay a once a year $204 deductible. This means the first $240 of care for doctors, labs, imaging and the like will be paid 100% by you. Once you’ve paid $240, out-of-pocket, you will be responsible for 20% of all covered services. There is no limit or cap to your out of pocket each year. Essentially, you will be expected to pay 20% no matter how high the bills are nor how many there are. |

| Costs | For Medicare Part A, there’s no cost as long as you’ve paid medicare taxes for at least 10 years. Part B will have a monthly premium of $174.70. The only exceptions will be if you have Medicaid (aka Medi-Cal) or if you are really high income (you will receive a notice with your adjusted monthly premium and appeal instructions). |

Many of those who do choose to stay with original Medicare will choose to enroll into a Medicare supplement (Medigap) plan as a secondary to their Medicare. These plans do cost extra each month, but they will greatly reduce or eliminate the copays and coinsurances with original Medicare.

Medicare coverage for hospital stays

Understanding the specifics of how hospital stays are covered under Medicare Part A is essential for anyone exploring their healthcare options. When we’re considering original Medicare, it’s important to distinguish between the roles of Medicare Part A and Part B, especially regarding hospital care.

| Coverage Type | Details |

| Hospital days 1-60 | You will pay a flat deductible of $1632 whether you are there for 1 days or 60 days. Additionally, if you are readmitted to the hospital within the same 60 day window you will not have to pay another deductible. |

| Hospital days 61-90 | After your initial 60 days you will pay a daily rate of $408 for days 61-90. |

| Hospital days 91-150 Hospital days 150+ | After your initial 90 days you will pay a daily rate of $816 for days 91-150. After 150 days in the hospital you will be responsible for all costs that accrue after 150 days. . |

Original Medicare’s coverage for hospital stays can surprise many. Although it may be less than many high deductible plans out there, it is certainly not as low or free as many expect it to be. For this reason, many choose to either supplement their Medicare with a Medicare supplement plan or go over to Medicare Advantage to reduce or eliminate these costs.

Does Medicare Cover Surgery

When considering surgeries, it’s important to know that Original Medicare typically covers medically necessary surgical procedures. Whether you’re facing a routine operation or an unexpected surgical intervention, understanding how Medicare steps in can ease your concerns about the financial aspects.

Medicare Part A Coverage: Primarily, Medicare Part A covers inpatient surgery costs. If you’re admitted to the hospital for surgery, Part A takes care of your stay, including your room, meals, and nursing services. However, it’s essential to know that Medicare Part A coverage for outpatient surgery varies, as Part A generally doesn’t cover these costs.

Medicare Part B is for Outpatient Surgery: For surgeries that don’t require an overnight hospital stay, Medicare Part B steps in. It covers the doctor’s services, outpatient care, and some preventive services.

Surgery Costs and Eligibility: While Medicare covers a broad range of surgeries, there are specific requirements and limitations. Eligibility for surgery coverage under Medicare Part A and B depends on the medical necessity and the procedural aspects defined by Medicare. Be aware of potential out-of-pocket expenses, such as deductibles and coinsurance, which can impact the overall cost.

What Does Original Medicare Not Cover

Despite its extensive coverage, Original Medicare doesn’t cover everything, including most prescription drugs, dental care, vision exams, and hearing aids. Many beneficiaries find themselves surprised by the gaps in coverage, especially when they encounter health issues that require services and items not covered under Original Medicare.

Here’s a breakdown of key areas where coverage falls short:

- Long-term care: Original Medicare doesn’t cover custodial care, which includes assistance with activities of daily living like bathing, dressing, and eating. This coverage can only be purchased through a private plan, through life insurance products, or as part of an annuity product.

- Most dental care: Routine dental exams, cleanings, fillings, dentures, and most dental surgery aren’t covered. This can lead to significant out-of-pocket costs for beneficiaries who need dental care.

- Vision and hearing aids: Medicare Part A and B don’t cover routine vision exams, glasses, or contact lenses. Similarly, hearing exams and hearing aids aren’t covered, requiring beneficiaries to pay for these expenses out of pocket.

- Pharmacy costs: You will have to enroll into a Part D drug plan or a Medicare Advantage plan that includes drug coverage if you want to have any medication coverage for drug that you pick up at the pharmacy.

Understanding what Medicare Part A and B don’t cover is essential for planning healthcare expenses. While Medicare Part B covers a wide range of outpatient services and Part A covers hospital stays, the gaps in coverage highlight the importance of considering additional insurance options like Medicare Advantage or Medigap policies to help cover what Original Medicare does not.

Enroll in traditional Medicare

Now, let’s talk about how we can sign up for traditional Medicare, a step that’s important for securing our healthcare in the future.

We need to understand the enrollment process thoroughly to make certain we’re not missing out on essential coverage or facing unnecessary penalties.

It’s about making sure we’re fully prepared and aware of what steps to take and when, so we can navigate this journey with confidence.

Medicare enrollment process

To enroll in traditional Medicare, it’s important we first determine our eligibility during the initial enrollment period, which typically starts no earlier than three months before turning 65. Guiding through the Medicare enrollment process guarantees we’re covered without delay. Here’s how you can apply:

- Online at SSA.gov. You will see the button on the home page. Create an account through Login.gov and follow the prompts.

- On the phone at 1-800-772-1213

- In person at your local SSA office. You can find the closest one at: www.ssa.gov/locator/

Timing our initial enrollment correctly ensures we avoid late enrollment penalties that can result in higher premium costs over time. Following the Medicare enrollment guidelines carefully is key to securing coverage when we need it most.

Medicare Advantage vs Original Medicare

Medicare Advantage offers an alternative to Original Medicare, bundling Part A and Part B coverage and often including prescription drug coverage (part D) and often includes extra benefits like dental and vision care. However, it’s important to be aware that these plans often come with network restrictions, which could limit your choice of doctors and hospitals.

When comparing Medicare Advantage plans to Original Medicare, it’s crucial to understand that Medicare Advantage provides an all-in-one alternative that combines Part A and Part B coverage. Here are some key differences:

- Medicare Advantage bundles hospital, medical, and often prescription drug coverage into one plan. It also lowers your out of pocket to the agreed copays depending on the service as listed in their summary of benefits. These plans can often have a lower copay than Original Medicare for many common services.

- In California, Medicare Advantage plans may offer additional benefits tailored specifically to Medicare and Medicaid recipients, providing more extensive coverage beyond Original Medicare’s basics. These would include the “flex” cards, food benefits, glasses, transportation, and more that you often hear about on the commercials and other ads out there.

- Medicare Advantage plans typically require you to use a network of contracted healthcare providers. Original Medicare allows you to see any provider that accepts Medicare nationwide without network restrictions. These networks fall under the rules below:

- HMO (Health Maintenance Organization): This is where you will have a specific network of doctors and hospitals you can see. You will be required to get authorizations and referrals from your primary doctor to see specialists and use services. The pros to this options is your out-of-pocket will be lower than the alternatives and they will often include the most “extra” benefits. The cons are that you will have absolutely no coverage for out-of-network doctors. This is the most common type of Medicare Advantage plan.

- PPO (Preferred Provider Organization): This is where you can see any doctor that accepts Medicare. You will pay lower copays for doctors that are in network and higher copays for everyone else (out-of-network). The in-network copays will often be higher than their HMO counterpart but less than with Original Medicare. The out-of-network copays can often be higher than Original Medicare. The pros to this option are that you do not need referrals to see any doctors allowing freedom to go where you would like, much like Original Medicare.

So in summary, while Medicare Advantage offers the convenience of having all coverage bundled into one plan, it lowers your out-of-pocket with in-network providers, but it does limit your choice of doctors and hospitals. With Original Medicare, you have greater provider flexibility but will often have to pay more for services.

Medicare Supplement Insurance

Medicare Supplement Insurance, often referred to as Medigap, helps cover the healthcare costs not paid by Original Medicare. It serves as an essential coverage option for many beneficiaries who rely on Medicare Part A and Part B. Medigap policies can greatly reduce out-of-pocket expenses that Original Medicare covers.

Unlike Medicare Advantage plans, which bundle services, Medigap policies supplement the coverage provided by traditional Medicare. This is where Medigap policies provide a financial safety net by covering the costs like copayments, coinsurance, and deductibles under Original Medicare. They are secondary to your Original Medicare allowing it to make all the decisions for coverage and network. This allows you to keep the simplicity and universality of Original Medicare’s coverage while removing the costs and out-of-pocket left behind.

Selecting the right Medigap policy requires understanding the different standardized plans available, labeled with letters. Each company that offers one of the standardized plans, like Plan G, will have the exact same coverage, only the monthly premium will vary. Since premiums can greatly vary by provider, it’s crucial to shop around and compare policies during enrollment periods to get the best coverage at the right price. This ensures we’re managing our Medicare costs effectively while also getting the coverage we need.

In essence, Medigap policies provide peace of mind, ensuring unexpected healthcare costs don’t derail financial security. They fill in the gaps left by Original Medicare for an additional monthly premium.