While you’re doing the math on how much money you’ll need for retirement, there’s another factor to consider when choosing to which Medicare plan is best for you.

Table of Contents[Hide][Show]

The length of time that you work is normally based on what company you work at, and how much you are paid.

If you are retiring and have employer insurance, then Medicare may or may not be beneficial for you. It’s going to depend on a few factors such as:

- How much your coverage costs

- How long you can keep it

- If you have a spouse or dependent that relies on your employer coverage.

- Most, who work for a company that offers secondary insurance, have the option of continuing that insurance for a monthly fee for as long as the insurance will continue.

- There are some other options if retirement secondary insurance is not provided by your employer.

- Many times when looking into what your secondary insurance options are with Medicare, you may find that it may be beneficial in other areas besides just medical coverage.

As you approach age 65 in the Central Valley of California, you may have questions about how your employer-provided insurance works with Medicare. It’s important to understand your options so you can make the best choice for your health care needs.

If you have insurance through your job, you might wonder if you need to sign up for Medicare. You may also be unsure about when to make the switch from your employer’s plan to Medicare.

In this article, we’ll explain how employer insurance and Medicare work together. We want to help you feel confident about your health care decisions as you get closer to retirement.

Primary vs Secondary Insurance

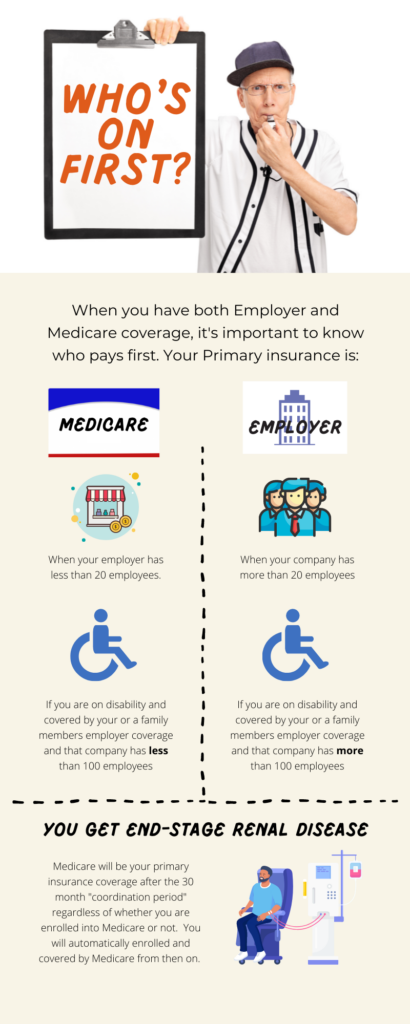

Understanding the order in which your insurances pay—known as coordination of benefits—is vital when you are covered by both Medicare and employer insurance. The primary insurance pays first and secondary insurance covers the rest. The role of Medicare, whether primary or secondary, hinges on factors such as your employment status and the size of your employer, influencing how you might choose to leverage Medicare alongside your employer benefits.

Medicare has rules about who pays first. Sometimes Medicare is the primary insurance, and other times it’s secondary. The Medicare “who pays first” grid can help you figure this out.

If you’re dealing with Medicare as either primary or secondary to your employer insurance, the Medicare Secondary Payer fact sheet and manual can be very helpful. They explain how the benefits work together.

Generally, if your company has more than 20 employees then your Medicare will be secondary. If they have less then you can expect your Medicare to be primary. Depending on the cost and coverage provided by your employer, it may be better to go to Medicare for everything. If your coverage is more than $300, then it starts to make sense to go to Medicare for everything. You can often enroll into a Medicare Supplement as a secondary insurance plan (Medigap) for less and have most everything covered. The Plan G, for example, pays for 100% of all Medicare copays and coinsurances after an annual $240 deductible – leaving you nothing to pay in terms of out-of-pocket expenses for all Medicare covered services. You can have Plan G, Medicare Part B, and a Drug Plan for just below $300 per month if you’re 65 years old, and just a slightly higher cost if you’re older.

By understanding these rules, you can make smart choices about your coverage and get the most out of your benefits. Whether Medicare is your primary or secondary insurance, being informed can help you navigate the health care system more easily.

Medicare While Working

If you’re still working full-time and have Medicare, there are some important things to consider. You’ll need to balance your needs with what Medicare and your employer insurance offer.

Choosing between Medicare and private insurance after 65 can be tricky. It’s important to understand how employer insurance and Medicare work together, including how benefits are coordinated. Some employers offer better copays for those with Medicare and some will even reimburse you for your Part B premium. No matter your situation, you will certainly want to discuss with your employer if their coverage changes with Medicare. Each employer individually decides the rules of their coverage so it’s important to confirm the details with your employer or benefits coordinator.

As you plan for health care in retirement, you’ll need to think about balancing Medicare with any retiree coverage your employer may offer. Learning about your Medicare enrollment options can help make the switch to Medicare go smoothly and help you decide if you want to keep the employer options or switch over to a private Medicare option.

We’re here to guide you through these choices. We want to make sure our community has the information they need to make good decisions about their health care. We know that shifting to Medicare while working full-time can be intimidating, but we’re here to help.

How Does Working Affect Medicare

If you’re still working past age 65, you might wonder how your job affects your Medicare enrollment. Working beyond age 65 does not inhibit your ability to enroll in Medicare. In fact, you can maintain your employer insurance while benefiting from Medicare. California’s regulations ensure you have flexibility in managing Medicare alongside active employment, with specific guidelines to support this coordination without forcing you to relinquish your employer coverage prematurely.

Your employer can’t force you to take Medicare. You can keep your employer insurance while working if you prefer.It’s important to understand what “active coverage” means. If you are actively working and have employer coverage then you do not have to enroll into Medicare and will not get a penalty for not doing so. You will have the options to take Medicare if you feel it will be beneficial to you.

If you choose to not enroll into Medicare while working, you will be given an additional enrollment period to do so once your employer coverage ends.

Enrolling in Medicare with Employer Insurance

If you have employer insurance, deciding whether to sign up for Medicare can be complicated. In Central Valley California, making this decision is especially important because of the unique health care options here.

Medicare vs Private Insurance

In terms of coverage: If you enroll into just Part A and Part B, then you will likely find Medicare lacking compared to many private employer plans. Most individuals who have Medicare will add a Medicare Supplement (Medigap) or a Medicare Advantage plan. Especially with the Medigap plan, you can often have much better coverage than an employer plan (For example, Medigap Plan G). In terms of Price: This varies a lot. The cheapest Medicare options are as low as $174.70 a month to have an Advantage plan, which will most often satisfy Parts A, B, and D. The most expensive Medicare options can be around $300 a month or more depending on your age (Plan G, with Parts A, B, and D). An employer plan can vary greatly from $0 a month to over $1000 a month. Because of this, price will depend on your specific situation.

Coordination of Benefits

When you have both Medicare and employer insurance, it’s important to know which one pays first. This is called “coordination of benefits.” Medicare has rules about who pays first. Sometimes Medicare is the primary insurance, and other times it’s secondary. Understanding these rules is key, especially when figuring out Medicare’s role compared to your employer insurance.

Medicare Enrollment Options

Learning about your Medicare enrollment options can help make the switch to Medicare go smoothly. Initial Enrollment Period (IEP): This is the 7-month period that starts three months before you turn 65, includes the month you turn 65, and ends three months after that month. It’s your first opportunity to sign up for Medicare.

Special Enrollment Period (SEP): If you have employer coverage through your or your spouse’s current job, you can enroll in Medicare without penalty anytime you are still covered and up to eight months after the job ends or the coverage stops, whichever comes first.

General Enrollment Period (GEP): If you miss the IEP and don’t qualify for an SEP, you can sign up between January 1st and March 31st each year. Coverage starts July 1st of that year, but late enrollment penalties might apply.

Medicare Advantage Open Enrollment Period: If you’re already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or revert to Original Medicare between January 1st and March 31st each year.

These options provide flexibility to integrate Medicare with your existing employer insurance, allowing you to optimize your healthcare coverage based on your personal and employment situation.

We know that shifting to Medicare while working full-time can be intimidating, but we’re here to help.

How Does Working Affect Medicare

If you’re still working past age 65, you might wonder how your job affects your Medicare enrollment. The good news is that you can work and have Medicare at the same time without any problems. Your employer can’t force you to take Medicare. You can keep your employer insurance while working if you prefer. It’s important to understand what “active coverage” means. In California, the Medicare employer coverage form plays a big role in how Medicare works with employer insurance.

If you have active employer coverage in California, you’ll need to make some decisions about Medicare as you get close to age 65. Don’t worry, Medicare will still cover you during this time. You won’t be left without the coverage you need.

Do I Need Employer Health Insurance if I have Medicare?

If you have Medicare, you might wonder if you still need employer health insurance. The answer isn’t always clear and depends on a few things, like whether your employer insurance can be secondary to Medicare. If you have Medicare, employer health insurance can give you extra benefits that Medicare doesn’t cover, like lower copays and additional services.

If your employer offers retiree insurance, this can be a good option. This is when they offer specific plans for those who have retired from working with them. Many are designed to coordinate with Medicare. These plans still vary greatly, so please review the specifics of each plan before deciding to go this route. But if your employer is considered a “small employer” under Medicare rules (less than 20 employees), Medicare will be your primary insurance, and your employer coverage might be secondary.

You’ll also need to think about Medicare Part B. If you already have Medicare Part A, you’ll need to decide if you want to sign up for Part B while you still have employer coverage. For some people, having both Medicare and employer insurance gives them a strong safety net for their health care needs.

HSA and Medicare

We’re now looking at how Medicare works with Health Savings Accounts (HSAs), which is important for anyone managing their health care options. When you sign up for Medicare, it’s important to know that you can’t contribute to an HSA anymore. This surprises a lot of people. Understanding how this works can help you plan for your health care expenses and make good choices about your savings and coverage.

Medicare and HSA Contributions

Understanding how Medicare and Health Savings Account (HSA) contributions work together can be complicated, especially if you’re moving from employer coverage to Medicare. Here’s what we’ve learned:

- Medicare enrollment and HSA: Once you’re on Medicare, you can’t put money into an HSA.

- HSA contributions and Medicare: You have to stop contributing to your HSA six months before Medicare starts to avoid tax penalties.

- Medicare and employer coverage: How Medicare Part A works with employer insurance can affect your HSA eligibility.

- Employer insurance with Medicare: Balancing employer insurance and Medicare can impact your HSA contributions.

- Medicare HSA rules: It’s important to understand these rules to avoid penalties and get the most out of your benefits.

Navigating these details can help you smoothly shift from employer insurance to Medicare without losing your HSA benefits.

Having Both Employer and Medicare

A lot of people wonder if they can have both employer insurance and Medicare at the same time. They want to know how these two types of coverage work together. The good news is that you can have both Medicare and employer insurance at the same time. How they work together depends on a few things, like the size of your employer.

If you have retiree health insurance through your employer, Medicare is usually the primary insurance. Your employer insurance can help fill in the gaps as secondary coverage. This is especially important if you’re thinking about how Medicare Part A works with employer insurance. If your employer is considered a “small employer” under Medicare rules, Medicare might be your primary coverage. It’s also important to know that you can choose to use Medicare instead of employer insurance, especially if it’s cheaper or better for your health care needs.

But this choice might affect your employer insurance. It could change the benefits you get and might make your Medicare Part B premium reimbursement taxable if the employer offers one. You should carefully look at your situation and think about things like who is the primary insurance holder and what benefits each type of coverage offers.

The size of your employer plays a big role in figuring out how Medicare and employer insurance work together.

Medicare Secondary Payer Fact Sheet

Understanding how Medicare works as a secondary payer can be complicated. You need to know when and how it works with other health insurance plans. We’re here to explain the key things that affect you, whether you’re switching to Medicare or managing both employer coverage and Medicare.

When Medicare is Secondary

Medicare is the secondary payer in some situations when you have other insurance, like through your current job.

- The order of payment depends on your age, disability status, and whether you have group health plan coverage based on your current job.

- If you’re under 65 and disabled, Medicare pays secondary to employer group health plans in companies with 100 or more employees.

- For those over 65 with employer coverage through your own or your spouse’s current job, Medicare also pays secondary when the company has more than 20 employees.

- Knowing when Medicare is secondary helps make sure your benefits are coordinated properly and all your claims are paid correctly.

Transitioning from Employer Coverage

It’s important to understand when to switch from employer group health coverage to Medicare to avoid gaps in coverage or late enrollment penalties.

- If you have health insurance through your own current job or your spouse’s job, you can wait to sign up for Medicare without a penalty while you’re covered by that insurance.

- Just make sure it counts as “creditable coverage” to avoid penalties later on. Your employer will be able to verify if the coverage is creditable. Most health coverage is.

- Once your job ends, you have 8 months to sign up for Medicare without a penalty. This is called a “special enrollment period.”

- This also applies if your employer coverage ends because of layoffs, business closings, or other reasons.

- You can also sign up for Medicare up to 3 months before your job ends to make sure you have continuous coverage.

Knowing these timelines can help you smoothly switch to Medicare.

Summary of Medicare and Employer Insurance

Understanding how Medicare and employer insurance work together can be complicated, but it’s important for people in Central Valley California, especially when moving from a job into retirement.

- Medicare, with its Part A and Part B, is the foundation for health care during retirement.

- But it’s also important to think about getting a Medicare Supplement Plan or Medicare Advantage plan, depending on your health care needs and budget.

- Employer coverage is important while you’re still working. It offers benefits like Health Savings Accounts (HSAs) that you can’t have with Medicare.

- The switch from employer coverage to Medicare, either through COBRA or directly into retiree insurance, is an important time.

This is when you need to understand the differences between Medicare Advantage plans and traditional Medicare with a Supplement Plan.

We’re here to guide our community through these decisions. We want to make sure you understand how to get the best coverage for you.

Whether that means keeping your employer coverage as long as possible or smoothly moving into a Medicare plan that works for your health and budget, we’re here to help.

Frequently Asked Questions

All of the reasons mentioned above should be considered when deciding to keep your employer coverage, add Medicare as a secondary insurance or transition to Medicare completely.

Whether it’s to stay or leave, help a loved one find coverage or explore your options for peace of mind, we can be a guide to educate and inform your decisions. Below are some of the FAQ’s we encounter a lot.

Can I keep my employer’s health insurance with Medicare?

Yes. In most cases if you choose to get Medicare Part A and/or B, then you can keep those and keep your employer coverage.

However, if you have Medicare and employer coverage you may risk losing your employer coverage if you enroll into a separate Medicare insurance plan (Medigap or Medicare Advantage).

It all depends on your specific employer plan. We recommend asking your HR representative or your employer for details.

Is Medicare cheaper than Employer insurance?

It depends. The most expensive Medicare options are around $300 a month for a 65-year-old (Medigap plan G, Part B, and Part D monthly costs).

If you have an employer plan that costs more than $300 a month, then Medicare may be cheaper and even cover more benefits than your employer coverage.

If you want just the “Bare Necessities” of Medicare – Parts A, B, and D – then you could be paying as low as $178 a month (Note: your out-of-pocket costs when you use certain services may be higher with this option).

Do I have to sign up for Medicare if I have private insurance?

No. The only exceptions are: if your employer is smaller than 20 employees, you have COBRA, or you are retiring. In all these cases, you would need to enroll into Medicare as it will have to be your primary insurance, or risk paying a penalty.

How does Medicare compare to private insurance?

In terms of coverage: If you enroll into just Part A and Part B, then you will likely find Medicare lacking compared to many private employer plans.

Most individuals who have Medicare will add a Medicare Supplement (Medigap) or a Medicare Advantage plan. Especially with the Medigap plan, you can often have much better coverage than an employer plan (For example, Medigap Plan G).

In terms of Price: This varies a lot. The cheapest Medicare options are as low as $170.10 a month to have an Advantage plan, which will most often satisfy Parts A, B, and D.

The most expensive Medicare options can be around $300 a month or more depending on your age (Plan G, with Parts A, B, and D). An employer plan can vary greatly from $0 a month to over $1000 a month. Because of this, price will depend on your specific situation.

What happens if you don’t sign up for Medicare part B at 65?

Unless your Medicare can be used as a secondary insurance (see FAQ #1), then you could be at risk for a Part B penalty. For 2023 this is $16.40 a month for life, for every full year you don’t have part B since the time you were first eligible to enroll.

You could also be at risk for a Part D penalty if your employer coverage isn’t considered “creditable”. This penalty for 2023, is a permanent monthly penalty of about $0.33 for every month you don’t have drug coverage (Note: this timer begins after the first 63 days without drug coverage).

Do I need Medicare part b if I have private insurance?

In short it depends on the size of your company and if you are actively working or not.

Medicare Part B is needed if:

-Your employer has less than 20 employees

-You are on COBRA

-You are on a Retiree plan (no longer working)

Medicare Part B is not needed if:

-Your employer has more than 20 employees and you are actively working

Can you delay signing up for Medicare part B?

Yes. If your employer has more than 20 employees, you are still actively working, and your employer coverage is considered “creditable”, then you can delay adding Medicare Part B. In most other situations, you will need to add Part B to have proper coverage and/or avoid a penalty.

Can you have private health insurance and Medicaid at the same time?

In most cases you can have both. Medicaid will always be a secondary to your employer coverage. The difference is that Medicaid IS NOT Medicare. It is health insurance provided by the state, often based on having low income. If you qualify for Full Medicaid, then you will likely want to drop your employer coverage since Medicaid will cover most all services with a $0 out-of-pocket cost.

Can your employer pay your Medigap Premium?

Not Really. They cannot pay your Medigap plan for you. This would be illegal. Here is one exception. If they choose to set up a section 105 reimbursement plan for their whole group, then you may be able to get some help paying for the premium. This is when an employer is allowed to reimburse employees, tax-free, for medical and other insurance expenses. If this is the case, it would look like a reimbursement for a certain dollar amount for certain kinds of Medicare coverage. This may or may not cover all your premiums for a Medigap plan. Ask your employer for more details.

Can my employer kick me off my group health insurance when I turn 65?

If you are currently working, then it is illegal for them to kick you off at 65. You can choose to voluntarily leave, but they cannot force or coerce you to leave.

If you are not working anymore, then they can offer different types of coverage for you since Medicare would be your primary. These options may not offer the same level of coverage you had while working. Also, they are not required to offer coverage for those who are no longer working.

Can you enroll in a Medigap plan even if you have employer coverage at a large employer?

Yes, you could, but it would not be worth it. You would be essentially paying for double coverage. In many cases, the Medigap plan might be a better set-up for you without the employer coverage. Besides, many Medigap plans would deny you for having employer coverage still in effect and would ask you to cancel it before they grant you coverage.