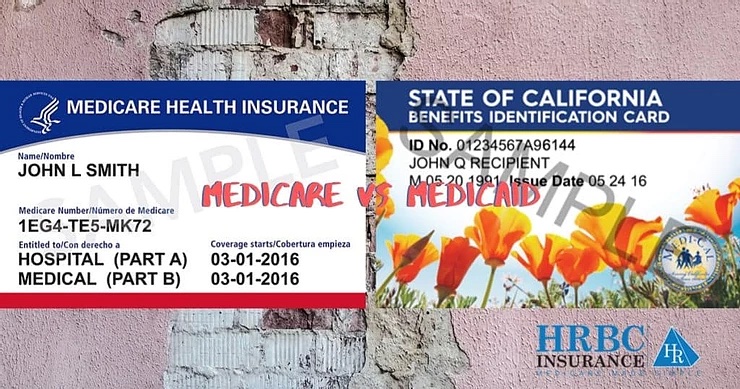

While both Medicare and Medicaid provide medical coverage, their functions and operations are very different. Here we will break down “Medicare vs Medicaid” – what each of them are, how you qualify for each, and how they work together.

Differences between Medicare and Medicaid?

Medicare

- A federal healthcare program funded by taxpayer contributions and premiums paid by those enrolled.

- Available to the elderly, disabled, and those with certain serious illnesses.

- Has a monthly cost that varies based on income level.

- Apply through the Social Security Administration.

- Covers Medi-Cal only

Medicaid

- A federal and state run health insurance program funded by taxpayer dollars.

- Enrollment is based on income level and disability.

- Has no monthly cost, but may have extremely low copays or out of pocket costs for some services.

- Covers medical and can cover medications

- Apply through Healthcare.gov or state Medicaid website

Quick note: Medicare is largely for those over age 65, while Medicaid is for those with low income. Many reading this probably live in California, and most Californians will know Medicaid as Medi-Cal. Medicaid is largely run by the state, hence the state-branded name. Each state will have their own variant of this for their own state.

What if I have both Medicare and Medicaid?

If you are over 65 and have low income, then it is very likely that you will have both Medicare and Medicaid (often classified as a “Medi-Medi” for short or formally as a full dual-eligible). If this is the case, you will need to know how Medicare and Medicaid coordinate with each other.

The first thing to note when you’re wondering about Medicare vs Medicaid, is that Medicare will be your primary and Medicaid will be your secondary coverage. This means that your Medicare will be the first to pay for any covered service and then Medicaid will step in to pay all or a portion of any copays or deductibles that are left over by Medicare (as long as Medicaid also covers that benefit). This will be important when you need something covered but only one insurance covers it. This shows up most often with things like incontinence supplies. Medicare does not cover incontinence products, but Medicaid does. Therefore, to get coverage the medical equipment company will need to get a denial letter from Medicare first before they request to have Medicaid pay for it. Knowing this can help you plan for the time it takes to go through the denial process.

Even if you happen to have both Medicare and Medicaid, there are still plenty of services not covered by either insurance. These services include glasses (unless after cataract surgery, and even then only for one pair), over-the-counter supplies, erectile dysfunction medications, personal emergency response button (commonly known as the “Help, I’ve Fallen and I Can’t Get Up” button), fitness benefits, and more. To get coverage for these services, you have the option to be enrolled in a Medicare Advantage plan (Part C). The good news is that these plans will likely be available at no additional cost for any dual-eligible individual, and most counties have a few “Medi-Medi” options to choose from. For more information on Medicare and Medicaid as well as Medicare Advantage plans tailored for dual-eligible individuals, contact a Local Medicare Agent to meet with a licensed professional to support you.

Qualifying For Medi-Cal

To find out if you qualify for one of Medi-Cal’s programs, look at your countable asset levels. You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. Some of your personal assets are not considered when determining whether you qualify for Medi-Cal coverage. For example, assets that do not count are:

- Your primary home

- One vehicle

- Household goods and personal belongings

- Life-insurance policy with a face value of $1,500 per person

- Prepaid burial plan (unlimited if irrevocable or up to $1,500 if revocable) and burial plot

If you meet the asset requirements, your income determines the Medi-Cal program for which you qualify.

Aged & Disabled Federal Poverty Level (A&D FPL) Program

Medicare vs Medicaid: If you are aged (65+) or disabled you may be able to get Medi-Cal through the Aged & Disabled Federal Poverty Level (A&D FPL) program. To qualify, you must:

- Be aged (65+) or disabled (meet Social Security’s definition of disability, even if your disability is blindness).

- Have less than $2,000 in assets for an individual ($3,000 for a couple). This program does not count all of your assets. For more information, see our Medi-Cal Programs – Qualification at a Glance chart (above).

- Have less than $1,271 in countable monthly income for an individual ($1,720 for a couple).

Medicare vs Medicaid: Medi-Cal with a Share of Cost (SOC)

If your monthly income is higher than the A&D FPL program (see above), but you meet the asset-level requirements, you may still be eligible for Medi-Cal with a share of cost (SOC). An SOC functions like a deductible. You must pay this amount in any month you incur medical costs. After your SOC is paid, Medi-Cal will pay the remaining amount of your medical bills for that month.

Note: A SOC is not a monthly premium. It is more like a deductible. It is the amount of medical expenses you are responsible to pay for before you can get full Medi-Cal coverage for the remainder of the month. If you have no medical expenses, you pay nothing. If your medical expenses don’t exceed the SOC then your Medi-Cal won’t kick in. Essentially, look at the SOC as the maximum amount you may pay each month in medical bills before Medi-Cal will kick in and pay the rest.

Your SOC is determined according to your monthly income, using the following formula: Medi-Cal subtracts $600 (for an individual) or $934 (for a couple) from your monthly income, and any other health-insurance premiums you may be paying.

For example, if you have an individual monthly income of $1,300, Medi-Cal subtracts $600 for a SOC of $700. This means you must pay at least $700 in covered medical expenses and/or health care premiums in a given month before Medi-Cal covers any of your health care costs for that month. For people with a high SOC, Medi-Cal is mostly a form of catastrophic coverage, meaning Medi-Cal will most likely only help them for emergencies or high-cost medical conditions. Because of this, if you have a SOC Medi-Cal, then you should purchase a Medicare plan as if you did not have Medi-Cal at all to avoid any billing errors.

Note: If you have Medi-Cal with a SOC, Medi-Cal will not pay your Medicare Part B monthly premium. This means your Part B premium will be deducted from your Social Security check each month. One exception applies if you are in a Medicare Savings Program (MSP) that pays for your Part B premium (QMB, SLMB or QI). If you are in one of these MSPs, you will not be affected. You may qualify for on of these is your income is lower than $1,406 for individuals and $1,903 for couples.

If you meet your SOC with medical costs in any given month, Medi-Cal will retroactively pay your Part B premiums for the month(s) in which the SOC is met. Medi-Cal will send the payment to the Social Security Administration (SSA), which will refund you the amount of the premium. Any Part B premium refund received from the SSA will be counted as a resource, not income, in the month you receive it.

Medicare Part D Coverage Gap (aka “Donut Hole”)

Medicare Part D Coverage Gap (aka “Donut Hole”)