Although most people here in the Central Valley call all forms of Medicare insurance a Medicare Supplement, there is a specific kind of coverage called this. More formally they are known as a Medigap plan, and many medical offices here in Fresno will call them the Medicare PPO plans. It’s important to note that they are note technically a PPO but they do operate very similar to them. If you have any questions, call your local Medicare supplement insurance agent.

With a Medicare Supplement Plan you are getting three things:

- Low to no copays for many Medicare services.

- Increased monthly premiums.

- Low to no network restrictions.

The price considers two main variables:

- How old you are

- How much coverage the plan you purchase will provide

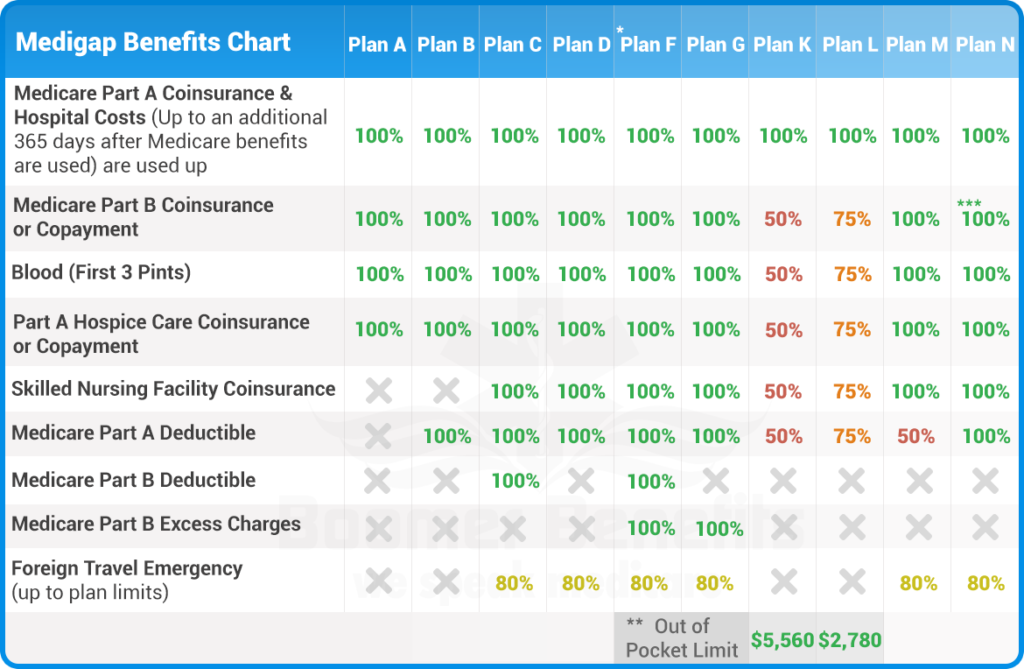

Each private insurance company can choose which plans they are going to offer; however, the plan benefits will be identical to all like plans that other private insurance companies choose to offer as well. For example, you may find Plan F at different companies, but by regulation the coverage of Plan F will be identical at each company. The monthly price of each Plan F is the only thing that may vary. Prices will often be within 5% of each other ($10 per month difference at most). Below is a chart of the various plans a company may offer and the coverage they provide.

Helpful Hint: All supplement plans are labeled with an alphabetical letter. Be sure not to confuse Plan C with Medicare Part C, which is a completely different package. For more information about Part C CLICK HERE

The big benefit to this plan type is that you do not need any referrals or authorizations to use this plan. You can go to any doctor that takes Medicare. It follows all the same rules of care that Medicare does without any new restrictions. This means you can go anywhere in Fresno, Madera, Tulare or even Stanford without any restrictions. All you have to confirm is if the doctor takes Medicare, which most of them will. Our insurance agents for medicare supplement plans can explain it all to you.

Medicare Supplement Insurance Agents Won’t Be Selling Plan F After 2020

*Medigap Plan F is also offered as a high-deductible plan by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2300 in 2019 before your policy will pay anything.

The Plan F is starred because it is the only plan that covers all Medicare copays and coinsurances. It’s also important to note that as of 2020 it will no longer be available to purchase. Only those who are already enrolled may keep it. So, now is the time to capitalize on the complete coverage it provides. To learn more about this CLICK HERE.

Plans K & L

**For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($185 in 2019), the Medigap plan pays 100% of covered services for the rest of that calendar year.

Plan N

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission. You can find this chart as well as other great info in Medicare’s Choosing a Medigap booklet as well, which you can find here.

Not listed, but important to note, is the High Deductible F Plan. This is often the most affordable monthly option for anyone. It is the F Plan with all of its “full coverage”; however, it doesn’t begin its coverage until you have met the $2,300 annual deductible. Once you’ve paid $2,300 toward Medicare covered services, at the original Medicare rate, then your plan will step in and act as if you have a Plan F.

Medicare Supplement Insurance Plans Don’t Cover These Services

Don’t Forget! These Medicare supplement plans do not cover services like dental, glasses, transportation, hearing aids, and more. Some plans may cover these services at an extra cost or as part of a special version of the plan.

Lastly, if you choose a Medicare Supplement plan as your option to manage your Medicare coverage, you will need to also purchase a