With a Medicare Supplement – and a Prescription Drug Plan – you are getting three things:

- Low to no copays and coinsurances for Medicare services.

- High Monthly Premium.

- No network restrictions.

Upfront the biggest barrier to enrolling into a Medicare Supplement plan – also known as Medigap – is going to be income. It’s for this reason only 16-18% of all Medicare recipients have chosen a Medicare Supplement plan as their option to manage their Medicare coverage. Monthly Premiums for these plans can range from as low as $40 up to $260 per month for a 65 year old depending on how much coverage you wish to have. The price takes into account two main variables:

- How old you are

- How much coverage the plan you purchase will provide

The more coverage a plan offers and the older you get, the higher the monthly price will be. This is important to note as plans will raise your monthly premium every year or two to account for your aging. Why is this? It’s because these plans literally supplement your Medicare (hence the name). You get coverage for everything original Medicare covers, then – depending which plan you purchase – the supplement will pay for all or some of your Original Medicare share-of-cost. Prices increase at a rate of about 20-30% over a 5 year period. So, if the plan costs $125 per month at age 65, then it will be around $180 per month at age 70.

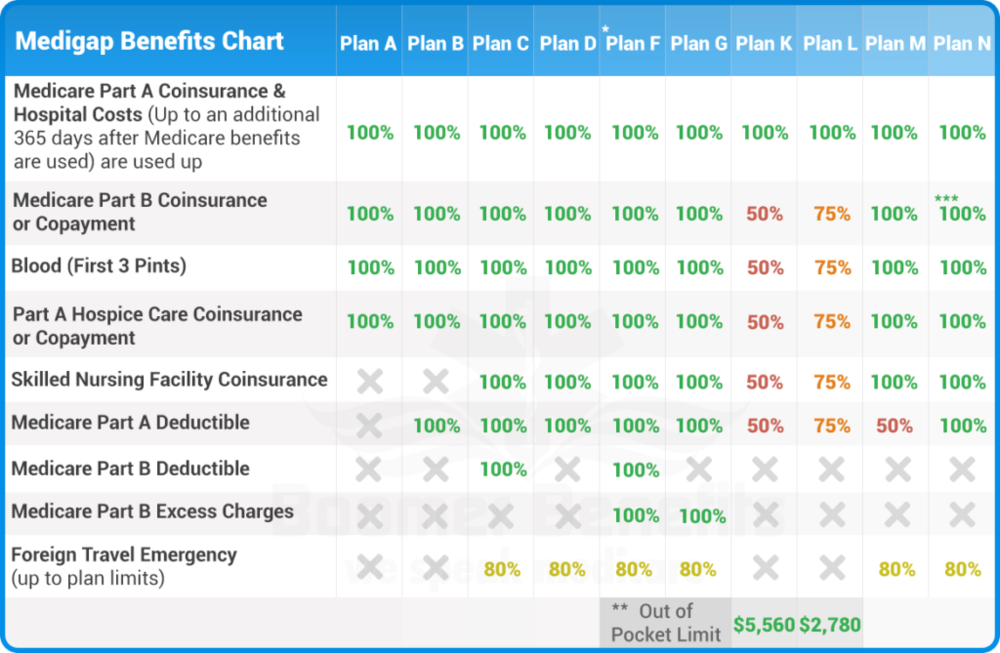

Each private insurance company can choose which plans they are going to offer; however, the plan benefits will be identical to all like plans that other private insurance companies choose to offer as well. For example, you may find Plan F at different companies, but by regulation the coverage of Plan F will be identical at each company. The monthly price of each Plan F is the only thing that may vary. Prices will often be within 5% of each other ($10 per month difference at most). Below is a chart of the various plans a company may offer and the coverage they provide.

Helpful Hint: All supplement plans are labeled with an alphabetical letter. Be sure not to confuse Plan C with Medicare Part C, which is a completely different package. For more information about Part C.

The Plan F is starred because it is the only plan that covers all Medicare copays and coinsurances. It’s also important to note that as of 2020 it will no longer be available to purchase. Only those who are already enrolled may keep it. So, now is the time to capitalize on the complete coverage it provides.

Not listed, but important to note, is the High Deductible F Plan. This is often the most affordable monthly option for anyone. It is the F Plan with all of its “full coverage”; however, it doesn’t begin its coverage until you have met the $2,300 annual deductible. Once you’ve paid $2,300 toward Medicare covered services, at the original Medicare rate, then your plan will step in and act as if you have a Plan F.

Don’t Forget! Similar to Original Medicare, these Medicare Supplement plans do not cover services like dental, glasses, transportation, hearing aids, and more. For a full list of what’s not covered What Medicare Does Not Cover. Some plans may cover these services at an extra cost or as part of a special version of the plan. To find out more about the special versions or to find a plan in your area, feel free to contact us or go to our supplement finder below.

Lastly, if you choose a Medicare Supplement Plan as your option to manage your Medicare coverage, you will need to also purchase a

Original Medicare And Prescription Drug Plan

Original Medicare And Prescription Drug Plan