With a Medicare Advantage Plan (Part C), You Are Getting Four Things:

- Low to no co-pays for many Medicare Services.

- Network restrictions.

- Low or no monthly Premiums

- Coverage for services excluded under original Medicare

A Medicare Advantage Plan is simply a Medicare approved private insurance company managing your Medicare benefits in addition to providing extra benefits. Essentially, Part C combines Part A, Part B and Part D as well as any other necessary medical services a person may require such as hearing and vision services. Best understood as a packaged deal or a combination program. When an independent Medicare agent enrolls you in a Medicare Advantage Plan, you are getting an all-inclusive deal, subject to its rules and regulations.

The deal is an impressive one. Many of the Original Medicare coinsurances are lowered much less than 20% and many times to $0. Your hospital deductible will often be removed and exchanged for a flat copay per day in the hospital for the first seven days. The best part is many services not covered by Original Medicare may be covered with a Medicare Advantage Plan. To top it off, a Medicare Advantage Plan will often include a

In essence, by enrolling into a Medicare Advantage Plan you avoid all Medicare penalties and receive a comprehensive set of benefits that are reasonable and attractive for those who may not be able to afford a Medicare Supplement plan. As stated there are a few rules to follow before you can receive some coverages through a Medicare Advantage Plan.

The rules are simple

Your primary doctor is responsible for obtaining approval for referrals to specialists and select medical services like surgeries and medical equipment.

That’s it. Yet, if you were not aware of this you may encounter issues. For you, the patient, this means you will have to wait a week or two before you can make an appointment for the new doctor or service while your primary doctor gets the referral done. If you tried to option the service or see the specialist without the authorization (approval for payment), then you would be on the hook for the entire bill. We see this most when someone’s family or friend refers them to an out of town specialist.

For example, say your friend talks highly of a doctor he knows in San Francisco. Since you likely live in the Fresno area most of your doctors in network will be in the surrounding central valley. You would need to get a referral to see that specialist in San Francisco, but it’s also very likely they are out of network due to how far they are from where you live.

This doesn’t mean you will be forgotten during urgent situations. Medical Groups and Health Plans have processes for urgent matters to allow same day and/or next day approval for all services as well as waiving of approvals when you visit the emergency room. If a procedure or referral is needed ASAP, then it’s possible to get you in to receive care ASAP. We have seen people even get referred to out of network doctors, such as Stanford and others in extreme situations where there are no doctors for a special need here in the Fresno area.

Two Facts About Enrolling Into Medicare Advantage With The Help Of An Independent Medicare Agent

We have mentioned Medical Groups and Health Plans a few times so far. Once a Medicare independent insurance agent helps you enroll into the Medicare Advantage Plan, the distinction will be irrelevant to you; however, when deciding which option to enroll in, you should understand what each entity is and their role in providing care and coverage best fit for you. This is because of two facts:

Fact #1

- Once enrolled, your care will be managed behind the scenes for you

- All your doctors (Primary & Specialists) have to be contracted with the same Medical Group to be covered by the Health Plan

Fact #2

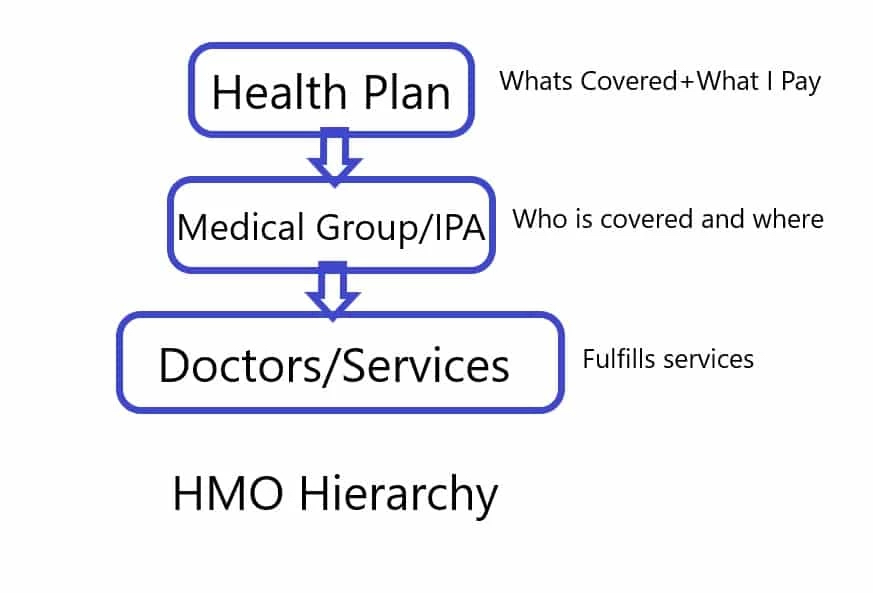

Is the most important in choosing the right plan and ensuring you have a great experience. To show why, take a look at the picture below.

Definitions From A Medicare Independent Insurance Agent:

- Health Plan: The insurance company you enroll in. These include the major brands you may recognize, such as Humana, Anthem, Blue Cross, Health Net, and more. They are responsible for deciding what is covered and your share of cost (copays/coinsurances).

- Medical Group/IPA: You may not recognize these entities, but they are named on your Member ID card. When it comes to determining your quality of care, choosing the right Medical Group/IPA may arguably be more important than the Health Plan. They are responsible for determining who you can see and where you can receive services.

Because the Medical Group determines who you can see, it’s important that you ensure all your doctors accept the same Medical Group. To find out if they do, you may either call each doctor or contact us to help you through it. If you happen to choose a Medical Group that your doctors don’t accept, then you will not be covered to see them. Each Medical Group only works with certain Health Plans. Because of these selective partnerships, there may be Health Plans with great benefits that would not be available to you because they unfortunately do not contract with your doctor’s Medical Group. Your doctors only determine which Medical Groups they work with, not which Health Plans.

In conclusion, the good news is that you have access to great benefits with reasonable rules. The responsibility is often up to you to ensure you are able to maintain your continuity of care (a medical phrase meaning to continue all current doctors and services). Medicare has rules stating that each agent should ensure this doesn’t get interrupted, but many will have stories that say otherwise. For this reason, setting up a Medicare Advantage Plan best fit for your individual needs is extremely important, and finding a trustworthy Medicare independent insurance agent to help you through it, even more so. Once it’s set up properly, the plan will take care of itself and you.

What is Telemedicine?

What is Telemedicine?