If you have both Medicare and Medi-Cal, then it’s vital you know what’s covered, what’s not and what is available to you. This page is meant for those with full Medi-Cal with no share-of-cost. If you have a share-of-cost, then you will need to search through the options for Original Medicare. For more information on share-of-cost.

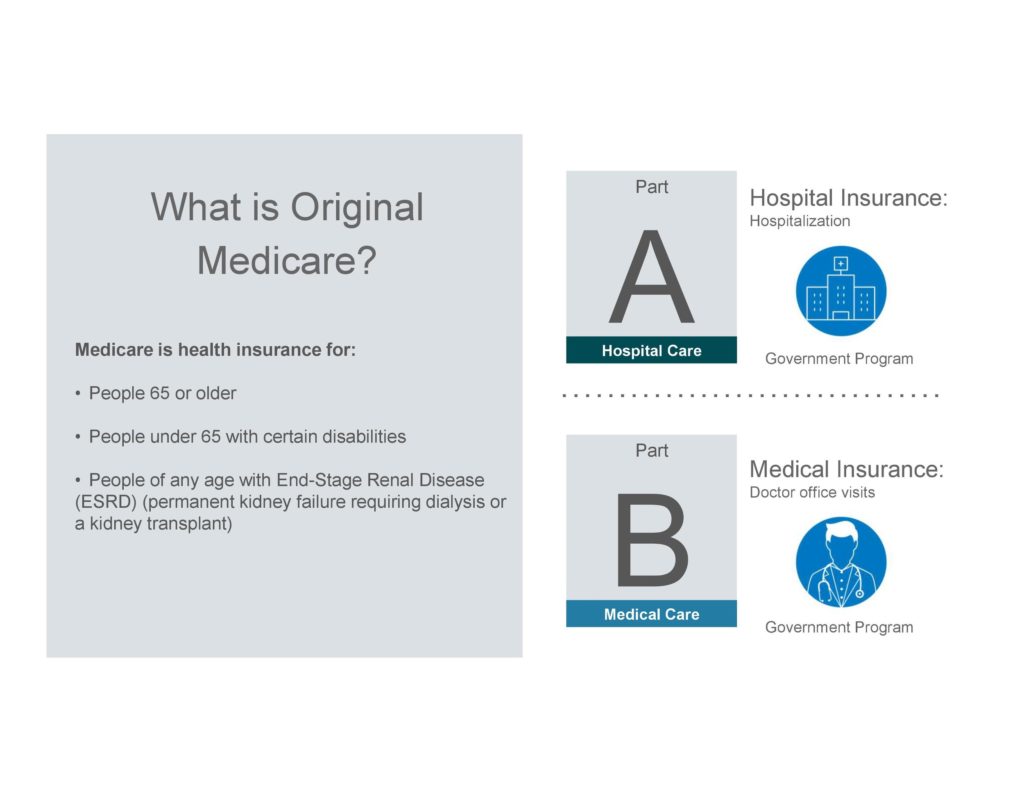

First, let’s cover Original Medicare since it will be your primary coverage. What this means is that it is the first insurance your doctors and the medical community will want to bill and will largely determine what is covered.

I Have Medicare and Medi-Cal How Do They Work Together?

Original Medicare Monthly Costs

Part A

- Part A will be free if you have worked and paid Medicare taxes for at least 40 quarters in the United States. Most people don’t pay a monthly premium for Part A, due to work history. If you are not entitled to receive Part A Premiums to see your options. Since you have Medi-Cal, any hospital coverage needs will often be covered by Medi-Cal; however, not having Part A will affect your options for additional benefits.

Part B

- Part B typically costs $135.50 per month. If you have full Medi-Cal, then the state may pay your Part B premiums. If you have have a share-of-cost for your Medi-Cal, then you may still be responsible for your Part B premium. To learn more about the different levels of Medi-Cal coverage.

Part A Covers

Hospital

- Inpatient Hospitalization

Home health care

- Medically necessary home health care services like wound care.

- Medicare-approved durable medical equipment (DME).

Hospice care

- $0 for hospice care.

Mental health inpatient stay

- Mental inpatient hospitalization.

Skilled nursing facility stay

- First 20 days of skilled nursing.

Part B Covers

Doctors and Most Medical:

- Most doctor services

- Outpatient therapy

- Durable medical equipment (DME)

- Clinical laboratory services

- Outpatient Mental Health

- Emergency room visits

- Medications Administered in the doctors office

- Cancer treatment

- Dialysis

What Medi-Cal Covers

Medi-Cal will typically cover all or most of your Medicare out-of-pocket costs (e.g. deductibles, copays and coinsurance). You can often expect to pay nothing for most services as long as you have full Medi-Cal with no share-of-cost.

Non-medical Home Health

Original Medicare will not cover any home health services that are not medically necessary. This includes having someone help you with bathing, going to the bathroom, cleaning the house, shopping, or any other service that can fall under assisted living with home health. This would also include any nursing homes or assisted living facilities. Thankfully, you will be able to receive these services covered through Medi-Cal.

Some Ancillary Services

There are many services that are considered “extra” that are not covered under Original Medicare. These include:

- Most dental care, including dentures, dental procedures or cleanings, fillings, dental plates, tooth extractions, and checkups. Medi-Cal provides limited coverage with a limited dental network.

- Hearing aids. Covered with Medi-Cal, but with limited options.

- Routine foot care. Covered by Medi-Cal.

- Eye exams for

prescription glasses. Medi-Cal covers exams, but not glasses. - Acupuncture. Not covered by Medi-Cal.

- Cosmetic surgery. Often not covered by Medi-Cal either.

Part D

Original Medicare does not include

Important Note for Medicare and Medi-Cal!

It’s very likely that you are on a managed Medi-Cal plan. Today, approximately 10.8 million Medi-Cal beneficiaries in all 58 California counties receive their healthcare through a managed Medi-Cal plan. You may recognize these as Anthem or Calviva Health Net Medi-Cal.

Medi-Cal Managed Care is when a private company contracts for healthcare services through established networks of organized systems of care, which emphasize primary and preventive care. Managed care plans are a cost-effective use of healthcare resources that aim to improve healthcare access and assure quality of care.

This is important to recognize because one of your options as a Medi-Medi is to enroll into a Medicare Advantage plan. These are managed Medicare plans that often use the same contracted networks and can provide coverage for many services that Medicare and Medi-Cal do not cover. If you enroll into a Medicare Advantage plan with the same network as your managed Medi-Cal, you can maintain care with all your current doctors and gain even more support that you didn’t have before.

What Are Your Options?

Enroll into a Medicare Advantage Plan with Medicare and Medi-Cal

A Medicare Advantage Plan is similar to a managed Medi-Cal plan, except that it is a managed Medicare plan. These plans are often called Special Needs Plans (SNP). They coordinate your Medi-Cal and Medicare as well as include a drug plan at no cost to you. In addition, they can help fill in the gaps that both Medicare and Medi-Cal do not cover, such as: glasses, transportation, over-the-counter, and more…LEARN MORE

Enroll into a Prescription Drug Plan with Medicare and Medi-Cal

In this option, you keep your Medicare and Medi-Cal the same and simply add a

Medicare Dental Coverage & What Dental Services Are Covered By Medicare?

Medicare Dental Coverage & What Dental Services Are Covered By Medicare?