Don’t let yearly rate increases price you out of the #1 Medicare supplement plan available. Keep your Plan F coverage and lower your premium by shopping your rate through the California Medigap Birthday Rule.

If you are within 30 days before or 60 days after your birthday you can keep your Plan F coverage and shop it around with a different Insurance provider with no Medical Underwriting. Get Guaranteed acceptance and keep your coverage at a lower rate.

Your Health, Your Choice

If we can be your rate with our rates below, schedule a call today and talk to a Local Medicare Agent who can answer questions and help you save today.

Your browser does not support iframes.

If you would like more information or would like to get started saving, we recommend scheduling a call with us or making an appointment. This way you get to have all of your questions answered by licensed professional and have them review to ensure any possible discounts or guaranteed acceptance periods are taken advantage of.

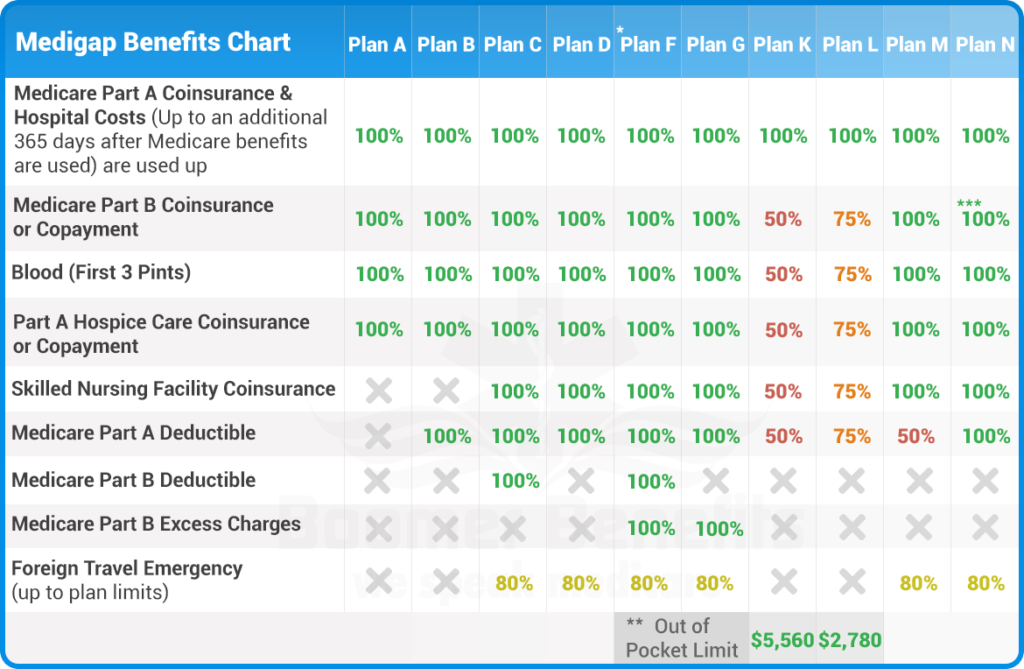

*Medigap Plan F is also offered as a high-deductible plan by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2300 in 2019 before your policy will pay anything.

**For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($185 in 2019), the Medigap plan pays 100% of covered services for the rest of that calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Focus On What Matters

Keep your coverage anywhere in America

If you pay your premiums on time, your plan stays the same and can’t be canceled if you move within the U.S.

Choose your Medicare doctor and your hospital

There are no network restrictions with Medicare Supplement Insurance plans, so you can see any doctor who accepts Medicare patients.

$0 Coinsurance and Deductibles

Why let out-of-pocket costs and medical bills threaten your way of life? Predictable low costs help you budget

MEDICARE DOESN’T COVER ALL OF YOUR HEALTH CARE COSTS.

You could be responsible for paying deductibles and coinsurance for inpatient hospital care and doctor’s visits.

Other health insurance plans limit you to a network of doctors and hospitals. Not to mention, they often only cover the lowest quality supplies and vendors.

Your Healthcare should be certain, not waiting for approval.

MEDICARE SUPPLEMENT INSURANCE CAN HELP.

With a Medicare Supplement Insurance plan, you can have protection against all, of the out-of-pocket costs with Original Medicare, and you’re never limited to a specific network of providers.

With this coverage, you can choose a plan with benefits at a cost you can afford.

Frequently Asked Questions

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies.These plans work alongside your Original Medicare benefits (Part A and Part B).

Who is eligible for Medicare Supplement Insurance?

You are likely eligible for Medicare Supplement Insurance if you are enrolled in Medicare Part A or Part B and are at least 65 years or older. In some states, you may qualify if you are under age 65 and have a qualifying disability.

When is the best time to enroll in a plan?

In most cases, once you are at least age 65 and you are enrolled in Medicare Part B, your Medigap Open Enrollment Period(OEP) begins.Your OEP will last for six months. If you purchase Medicare Supplement Insurance during this period, you cannot be denied coverage or charged more for your plan based on pre – existing medical conditions.

What are the differences between plans?

Each Medicare Supplement Insurance plan offers a different combination of coverage benefits, which can include full or partial coverage for some of your Medicare out-of-pocket costs. Speak with a licensed insurance agent at 1-866-872-9749 who can help you find the plan that fits.

How do I get started?

To find the right Medicare Supplement Insurance plan for you, request a free quote below or call 1-866-711-8203. Licensed insurance agents can answer your Medicare questions and help you compare plan benefits, all at no charge to you!